Renters Insurance in and around Garner

Get renters insurance in Garner

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

There's a lot to think about when it comes to renting a home - furnishings, size, price, house or condo? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Garner

Your belongings say p-lease and thank you to renters insurance

Why Renters In Garner Choose State Farm

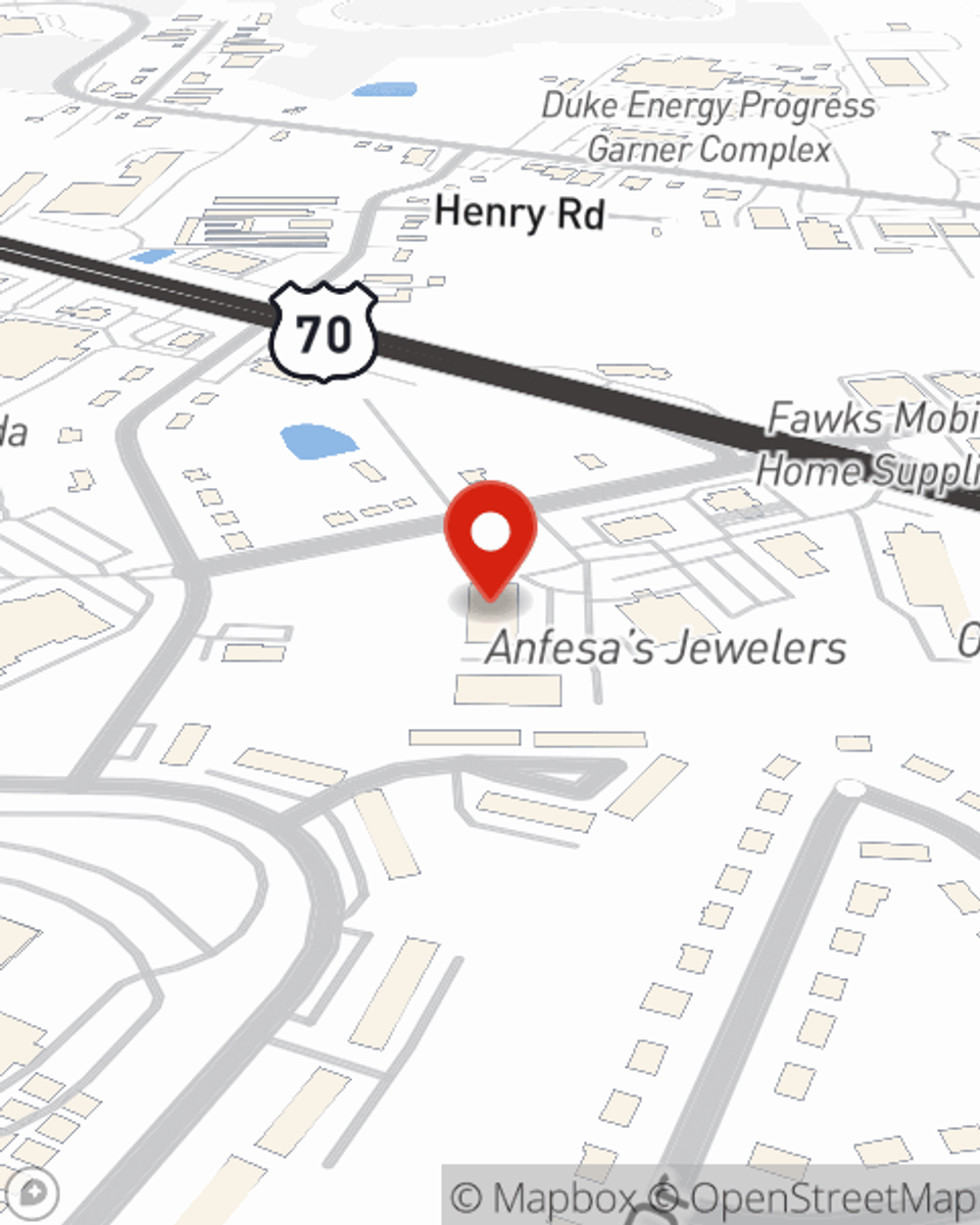

The unexpected happens. Unfortunately, the stuff in your rented townhome, such as a tablet, a smartphone and a laptop, aren't immune to vandalism or theft. Your good neighbor, agent Meg Hunter, has the knowledge needed to help you figure out a policy that's right for you and find the right insurance options to protect your personal posessions.

It's never a bad idea to make sure you're prepared. Call or email State Farm agent Meg Hunter for help learning more about coverage options for your rented unit.

Have More Questions About Renters Insurance?

Call Meg at (919) 779-4880 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.